Do you remember the dotcom bubble at the turn of the millennium? Even back then, German consumers were able to make payments with their mobile phones. A start-up called Paybox enabled mobile payment transactions that leveraged the German domestic debit system to settle transactions on consumers’ current accounts. All a consumer had to do was add their bank account details as a funding source to the Paybox system.

After the first successes of Paybox a dozen similar copycats driven by dumb money appeared on the German market. Even German mobile network carriers introduced proprietary mobile payment solutions all of which were similar from a functional point of view. As a typical side-effect of the dotcom-hype, all providers truly believed that consumers would enroll and add their bank details to all (more or less similar) payment solutions. And even more irrationally, they believed that merchants would implement 10+ similar payment methods on their checkout pages.

More than a decade has passed since then. Today the payment model is known as the e-wallet and consumers are still asked to add their bank details for Automated Clearing House (ACH) transactions with e-wallets. And the topic of mobile-payments is hot once again. The current market leader is no longer Paybox, but has a pretty similar name: PayPal. Apart from this, history repeats itself.

27 active or announced wallet payment providers in Germany alone

There is a huge e-wallet hype right now, just as there was more than a decade ago. All providers try to consolidate traditional bank payment options (like cards, ACH clearing) combined with a new user interface in a (mobile) e-wallet product. And now, just as there were a decade ago, there are far too many e-wallet providers are active in the market.

| Amazon Payments | Kesh | PayMey |

| Cashcloud | Masterpass (MasterCard) | PayPal |

| Click&Buy | Mpass | Postpay |

| Coolpay | mpax | Qooqo |

| eplus Mobile Wallet | MyWallet (T-Mobile) | Skrill-Moneybookers |

| Fidorpay | Netteller | Sqwallet |

| Opentabs | V.Me (Visa) | |

| go4q | Paij | Vodafone Wallet |

| Ipayst | Paycash | Yapital |

Table 1 27 payment providers offering e-wallet services in Germany

Although Germany, as Europe’s largest economy, is a major payments market, it can not sustain such a large number of individual solutions. Only one provider, Google, has pulled back again its NFC-based wallet solution that it had previously announced.

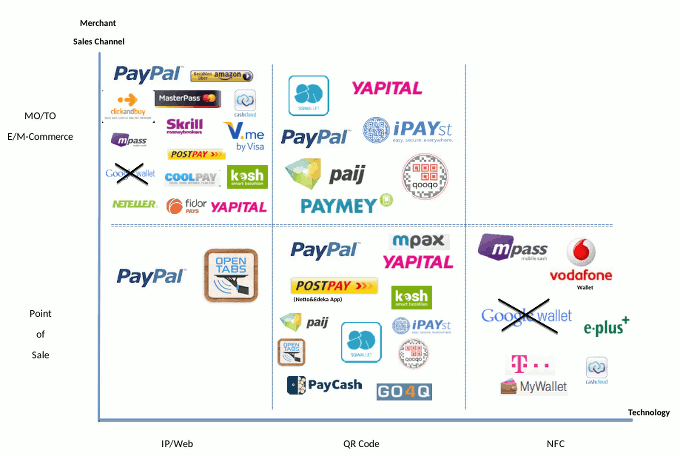

Figure 1 Payment providers: channels and technologies

This Town Ain’t Big Enough – why many providers will soon disappear

The number of current wallet-payment providers is quite surprising. The Payments market is one dominated by network effects. They lead to monopoly- or oligopoly-structures. We all know those effects from other markets like search engines (Google), Operating Systems (Windows at PCs, Android and iOS at mobile devices), Software (Microsoft’s Office Suite).

Though all those PayPal challengers are running big bets, they also make fundamental mistakes in their strategy. I would like to highlight just a few of them:

- Missing a real differentiating factor in their products All those providers are copycats of PayPal, without offering any fundamentally new ideas in their products that can’t also be copied by others. Just a look at the matrix in figure 2 and note the domination by PayPal in its product set-up already today.

- Providers block themselves before the market consolidation starts The vast majority of merchants will just sit and wait until market consolidation has started. It seems inevitable that in just a few months 20+ providers will have disappeared again. Why invest in new implementations before consolidation has started? Time runs out very fast especially for poorly funded companies.

- Every provider believes to be more successful on its own Also MasterCard, VISA and the mobile network operators overestimate the power of their brand. They only have a chance by offering common solutions. On its own every provider has very poor power. There are more active PayPal accounts in Germany than MasterCard and VISA branded credit cards each. The effort of consumer acquisition is usually heavily underestimated and yet is one of the most important success factors. This market fragmentation will hinder consumer acquisition heavily.

- Strong household brands are not being used to build-up consumer trust In its infancy PayPal co-branded its still then largely unknown brand with the claim “an eBay-Company“. By doing so PayPal benefitted from the consumer trust in the strong eBay brand. Companies like Yapital, Click&Buy and mpass are all 100% subsidiaries of strong German household brands (Otto, Deutsche Telekom, and Telefonica respectively) – yet it was decided to keep those payment brands separate from the established brands. Do the companies anticipate potential negative effects and therefore keep the brands separate?

- Missing or low value proposition Most of the new wallet payment providers have a technology-obsessed approach. There is clearly a lack of focus on value proposition for consumers and merchants. What is the problem that is solved at a POS terminal? Mobile NFC or QR codes at terminals are not improving or even disrupting existing payment processes. To the contrary, a somewhat laborius payment process goes something like this: unlock smartphone, open and unlock wallet app, hold up to- and read the QR code. Why do the providers believe customers will pay by this technology if a traditional (NFC based) card or even cash is faster and more convenient to use.

Where are the banks?

All the providers mentioned above leverage the existing bank payment systems. Additionally they intermediate the user interface between consumer and bank especially when it comes to payments funded by bank products. Why are the banks not becoming more active in this segment? In fact, they possess solutions to key pieces of the puzzle to be successful:

- They have established relationships with consumers and merchants / corporates. So there are very few hurdles for registration and acquisition

- They possess the best knowledge about solvency on both sides of a transaction (consumer and merchant). Complex risk systems and losses can be minimized leveraging this information. This can have a great impact on the overall fee level.

- Banks are still most trusted when it comes to payment systems – even still despite the latest financial crisis

- The current account is already a wallet product allowing payments across multiple channels (cards, EFT, domestic debits, OBEP-Payments etc.). What is missing to become an e-wallet is “just” a lighter online-banking front-end

Currently it does not look like there is a serious challenger to PayPal on the German market, although despite this, the existing competition is always welcome. The banks have all the assets to own this market but appear to have decided not yet to enter.

Editor’s note: This article first appeared in German on Der Bank Blog.