On the back of ZTE’s announcement that “the major operating activities of the company have ceased”, many are wondering just how much of the market ZTE commands. We looked at some data from DeviceAtlas for the answers.

On the back of ZTE’s announcement that “the major operating activities of the company have ceased”, many are wondering just how much of the market ZTE commands. We looked at some data from DeviceAtlas for the answers.

Amidst the controversy surrounding ZTE’s flouting of trade sanctions against Iran, the US department of Commerce slapped a 7 year ban on US companies – such as chip giants Qualcomm and Intel and others- from supplying the Chinese device manufacturer. ZTE is thought to be dependent on US firms for up to a third of the components they use.

ZTE, who were hit with fines of approximately $900 million last year for the infringement of the embargo on Iran, says it will try to reverse the move.

Yesterday, the crisis deepened as Australian operator Telstra announced they would stop selling ZTE devices. Then ZTE made the shock announcement that they are to cease operating activities. But how much ZTE tech is already out there?

Update

In a story that just keeps on giving, a surprise tweet from POTUS, strongly implies that the ban may soon be lifted. We’ll be watching to see how this pans out. Does this mean ZTE is not “suspect tech” anymore?

President Xi of China, and I, are working together to give massive Chinese phone company, ZTE, a way to get back into business, fast. Too many jobs in China lost. Commerce Department has been instructed to get it done!

— Donald J. Trump (@realDonaldTrump) May 13, 2018

ZTE market share of browsing

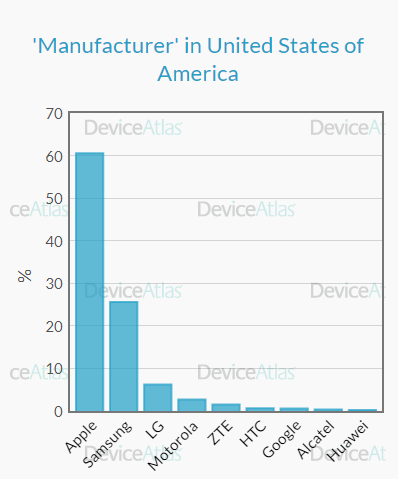

According to the latest data from DeviceAtlas, ZTE was the 5th largest device manufacturer in the United States in terms of traffic generated by ZTE made phones.

ZTE US browsing share via DeviceAtlas

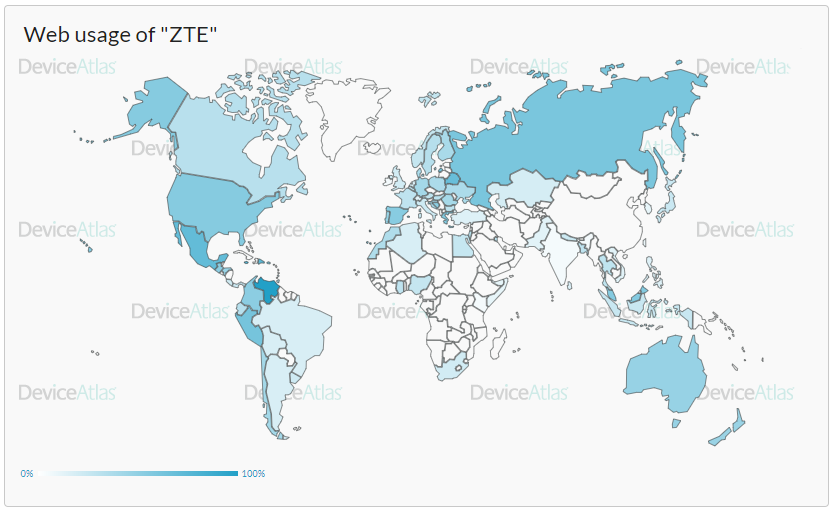

Other markets where ZTE devices enjoy considerable market share included several countries in South America including Mexico, Venezuela, Peru, Ecuador and Columbia, Russia, Australia and New Zealand as well as Spain and Greece.

Suspect Tech

Huawei who have also been the subject of US government restrictions in the broadband infrastructure market and have had its devices banned from US military outlets also figure in the top 10.

With that much ‘suspect tech’ out there, many will be interested in a means to track traffic from these and other chinese device manufacturers, in the broader context of trade relations between the US and China.

We’ve been tracking the growth of Chinese handset manufacturers for some time, and China’s stated aim to become a dominant force in technology with its Made in China 2025 makes many policymakers deeply uneasy. Earlier this year, we saw the blocking of Broadcom’s aggressive takeover bid for Qualcomm. For each and every action, though, there is an equal and opposite reaction, so whether that comes in the form of more Chinese action in the nascent 5G market, or an escalation into a messy trade war remains to be seen.

Leave a Reply